When it comes to borrowing money, there are two primary loan categories to consider: unsecured loans and secured loans. Each option has its own set of benefits and drawbacks, so it’s important to thoroughly analyze your financial circumstances and goals before making a decision. In this blog post, we will explore the distinctions between unsecured and secured loans to help you choose the option that best suits your needs.

What Is an Unsecured Loan and How Does It Work?

Unsecured loans are loans that do not require any collateral to be pledged as security. Instead, lenders assess the borrower’s creditworthiness based on factors such as credit history, income, and other relevant factors. If approved, the borrower receives a lump sum of money and agrees to repay the loan with interest over a set period of time. Examples of unsecured loans include personal loans, credit cards, and student loans.

Pros of Unsecured Loans:

- No risk to assets: Since no collateral is required, you won’t be risking your assets if you are unable to repay the loan.

- Higher debt ceiling: If you have a high income, your credit limit will also be higher, allowing you to access more credit.

Cons of Unsecured Loans:

- Lower credit limit for low-income individuals: If your income is low, the amount of unsecured credit you can obtain may be lower than you need.

- Expensive for late repayments: Late repayments can make your loan more expensive due to higher interest rates or penalties.

What Is a Secured Loan and How Does It Work?

A secured loan is a loan that requires collateral to be pledged as security. Collateral can be an asset such as a house, car, or savings account. The value of the collateral is evaluated by the lender, who determines the loan amount based on that value. If the borrower defaults on the loan, the lender has the right to take possession of the collateral to recoup their losses. Mortgages, vehicle loans, and home equity loans are common examples of secured loans.

Pros of Secured Loans:

- Lower interest rates and longer loan terms: Secured loans generally have lower interest rates and longer repayment terms, making them less expensive to borrow.

- Access to more credit: By offering valuable assets as collateral, you can access higher loan amounts.

Cons of Secured Loans:

- Risk to assets: If you default on a secured loan, the lender can sell the collateral to recover the remaining balance, putting your assets at risk.

- Lower credit for assets with little value: If your assets have little value, the amount of credit you can obtain may be lower than anticipated.

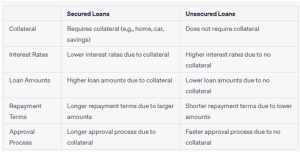

Key Differences between Secured and Unsecured Loans:

Which Loan Should You Choose?

Choose a secured loan if:

– You need a larger loan amount.

– You have valuable assets that can be used as collateral.

– You prefer longer repayment periods and lower interest rates.

– You are confident in your ability to repay the loan and protect your assets.

Choose an unsecured loan if:

– You don’t have substantial assets to use as collateral.

– You need a smaller loan amount.

– You have a high income and good credit.

– You’re comfortable paying more in interest and having a shorter repayment period.

When deciding between secured and unsecured loans, it is crucial to consider your financial health, the type of credit you need, and your risk tolerance regarding your valuable assets. Assessing your financial situation and goals will help you make an informed decision. Remember to carefully read and understand the terms and conditions of the loan agreement, including interest rates, repayment periods, and any associated fees or charges. If you have any doubts, seek clarification to avoid unexpected costs or penalties.

If you’re considering an unsecured loan, OT Credit offers fast and easy loan applications. As a trusted lender, OT Credit provides transparent and fair loan products with clear information about interest rates and fees. We also offer flexible repayment plans tailored to your needs. Apply with OT Credit today for a reliable lending experience. No commitment is required.

Remember, taking on a loan is a financial responsibility, so it’s important to borrow wisely and manage your finances effectively.